The SULA LABS Report No. 3

Authors: AJ Addae, Kahina Jean-Baptiste, Poornima Dorairaj

Abstract

Summer is on the horizon, meaning we’re expecting sunscreen launches, fun brand activations, body care launches, conferences, and of course, a major shift in our skin care and body care routines.

On our end, we’re gearing up for some exciting product launches with our brand partners, as well as a super exciting SULA LABS activation, which will be our first one ever! This month, we also had the exciting opportunity to be featured in a few channels, such as:

Gloss Angeles Podcast episode with host Kirbie Johnson and guests Yarden Horowitz, the founder of Spate + our founder AJ Addae

Cosmopolitan article How the Pandemic Effected 2023 Skincare and Beauty Trends

Byrdie article Yes, You Need to Wear Sunscreen on Your Lips—Hear’s Why

The Zoe Report article Unpacking Clean Makeup’s Mold Problem

In this issue of the SULA LABS Report, we examine microbiome-based skincare, provide packaging recommendations, and ask our founders: How specific does a skincare category need to be for you to dominate the space?

Now, let’s get into it.

Cash Flow

These days, if you take a scroll through Instagram, you’ll perhaps see all kinds of skincare products that have a very specific niche and marketed towards a very specific category.

Of course, we are not new to category-targeted marketing. Take the Black beauty category for example, with globally retailed giants such as The Lip Bar by Melissa Butler, to Tristan Walker & Company ushering in a generation of successful indie Black men’s grooming brands, like Erick Heckstall.

Nevertheless, we have seen a marked surge of niche-targeted DTC brands leading with a unique value proposition (UVP) that targets an incredibly specific mission, or an incredibly specific demographic. Some key examples are brands that are early players in the Generation Alpha space — a demographic whose oldest members are just now entering high school. Some other examples are:

4am skin — a brand inspired by your skin’s circadian rhythm, designed to support tired skin and simplify your skincare routine.

Current State — a skincare brand with multiple SKUs per product category that address your skin’s specific needs at that current state.

Insanely Clean — a men’s skincare brand with easy-to-use essentials.

Futurewise — a skincare brand whose entire product range is specifically dedicated to slugging your skin.

LOOPS — a skincare brand whose majority product range is active ingredient-infused hydrogel masks.

selfmade — a skincare brand whose marketing language is deeply embedded in conversations around mental health.

Plumpie — a skincare brand whose entire product line is hydrocolloid patches in the style of stickers.

And the list goes on. The most interesting part is that these brands were all launched in the past 3-4 years — and it can’t be coincidental that many of these brands are either completely DTC, or stocked in up to two retailers such as Urban Outfitters (notorious for bringing in indie brands). This indicates that these brands pretty closely follow the classic DTC strategy, which typically looks like:

Securing a strong UVP towards an identified white spaces

Some white spaces demonstrated above are: lack of conversation around skincare and mental health, lack hydrocolloid patches that look fun, lack of single-use sheet masks, and lack of products that don’t adhere to skin typing just to name a few

Centering products on a cohesive brand story*

*Typically, the brand story starts with a problem experienced by the founders

Beginning as DTC brand to establish proof-of-concept without retailer intervention

Being picked up by retailers with audiences that are connected to your UVP

From this strategy, two questions tend to come to mind for founders — what determines a valid category? Furthermore, how do you prove to both investors, and potential consumers, that your product does have a market?

Below are three ways to prove market validation:

Data. Collecting data through methods such as reviewing SEO data to understand internet traffic around your specific market, consumer surveys to ask consumers directly what gaps they are seeing, or sourcing an amalgamation of research studies that have not yet successfully identified a consumer solution at the industry level (versus at the academic level)

Proprietary nature. In the words of the infamous Shark Tank host Kevin O’Leary, “What is proprietary about this?” — meaning, does your product have features unique to your brand? Or can other players in the space hijack and reproduce your magic? Some solid ways to secure proprietary status are through patents, and trademarks (which of course requires quite a bit of capital).

Competitor Analysis. What are your competitors of all sizes doing to address this market? Furthermore, in what ways are their consumers still dissatisfied? How can you address this problem in a way that others can’t?

Lastly, we always invite founders to ask themselves: Is there a need for your brand pioneer a specific, never-before-seen category?

With that, we’re curious to know from our readers:

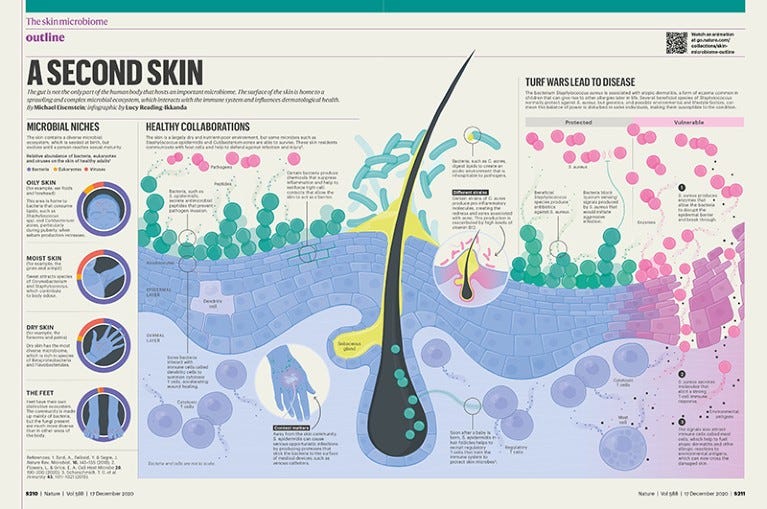

At this point, we’ve all become aware of the skin microbiome, and just how important it is in determining your skin’s behaviors, as well as regulating your skin’s immune system. In 2018, prestigious research journal Nature published a study that declared that the skin microbiome functions as a “second skin”.

The sentiment of the skin microbiome playing a huge role in your skin’s functions has reflected greatly in product trends over the past few years. We saw this first in 2015 when Mother Dirt entered the market as the only brand to have products that contain probiotics, which are live bacterial cultures. The brand was later acquired in 2019.

We still continue to see microbiome-approached skincare as a UVP now with brands such as Phyla, and Dr. Whitney Bowe. Similarly here at SULA LABS, we regular receive product requests that seek to use this approach.

While it is a fact that the skin microbiome benefits from topical (and ingestible) postbiotics, probiotics and prebiotics, the scientific community continues to note that we still don’t know even half there is to know about the skin microbiome. Due to factors such as the skin’s microbiome changing overtime, and each person having vastly unique microbiomes, it is difficult to employ a one-size-fits-all approach when claiming the benefits of microbiome-based skincare. Despite this, there is a very clear demonstration of the benefits of microbiome-skincare. Several studies investigate (and prove) the diminishment of skin concerns such as acne and eczema through microbiome intervention — both topically and orally. Furthermore, several prebiotic and postbiotic skincare ingredients such as Lactobacillus ferment extract have become a staple in INCI lists nowadays, such as in:

Cocokind Postbiotic Acne Serum ($20)

Contains: Lactobacillus ferment extract, 1.5% salicylic acid

Biossance Squalane + Probiotic Gel Moisturizer ($54)

Contains: Lactococcus Ferment Lysate

Tom’s of Maine Prebiotic Liquid Hand Soap ($6)

Contains: Inulin (a prebiotic)

La Roche-Posay Lipikar Balm AP+ Intense Repair Moisturizing Cream ($20)

Contains: Prebiotic thermal spring water and Aqua posae filiformis (APF)

Aveeno Eczema Therapy Moisturizing Cream ($19.99)

Contains: Prebiotic oat extract

Marie Veronique Prebiotic + Probiotic Daily Mist

Contains: Microbiotic complex (a proprietary mix of 34 live probiotics, plus prebiotics and postbiotics)

Therefore, it’s quite clear that skin-supporting microbes have entered the chat, and are most definitely here to stay. However, there are a few key nuances to microbiome-inspired skincare that have been identified by researchers.

Dosage. The scientific community still has yet to determine the appropriate dosage for a vast majority of strains that are complementary towards the skin’s microbiome, despite there being a few star-studded strains that you might see everywhere (namely, lactobacillus ferment extract which comes from bacteria, or Saccharomyces ferment extract which comes from fungus)

Viability. The scientific community still has yet to uncover just how long specific strains can stay on the skin’s surface in a way that is inherent to actives in skincare products (such as retinoids and acids)

Nomenclature. We’ve seen countless times in which skincare products use postbiotic lysates (segments of dead bacteria that your bacteria can feed on to upregulate skin benefits), but claim that the products are probiotics (live bacterial cultures).

Shelf life. We’ve seen brands use postbiotic lysates as a vehicle for product preservation, but this approach doesn’t often live up to the standard of a classic broad spectrum preservative. Another shelf life issue is that incorporating live cultures of bacteria into a product poses preservation measures such as refrigeration and a super short shelf life.

Despite the nuances, postbiotic, prebiotic, and probiotic approaches to skincare are extremely promising for the future of skincare benefits, as exciting research continues to roll out new discoveries on the benefits of these adorable little skin bugs. In fact, LA dermatologist, Janine Hopkins noted at the 2023 American Academy of Dermatology conference this year, “I was intrigued by a new product, BioJuve, that can help optimize a healthy skin microbiome to help reduce the occurrence of acne and rosacea.” Similarly, the 2022 Society of Cosmetic Chemists conference had several keynotes that declare that microbe-based skincare approaches just might be the next step for the skincare industry.

Now, we are curious to know from our readers:

Ingredient & Vendor Reports

This month, we wanted to start this section with our favorite sustainable packaging suppliers at the moment:

New High Glass — an all glass-based sustainable packaging company that allows you to purchase products directly from the website (and has a GREAT low MOQ).

Plaine Products — sustainable packaging company that provides aluminum-looking materials without the oxidation potential of classic aluminum packaging.

PaperTubeCo — sustainable paper tube company with sturdy, biodegradable paper materials that accommodate a majority of personal care products.

And now lastly, moving into our ingredient report:

18-β Glycyrrhetinic Acid — A Licorice Root Underdog

INCI: Glycyrrhetinic Acid