The August SULA LABS Report - Do celebrity and sales mix? + SULA BUTTER Results

Authors: AJ Addae, Kahina Jean-Baptiste, Poornima Dorairaj

Abstract

This month, we cover biotechnology/brand incubator Amyris’ bankruptcy, unit cost recommendations, Naturium’s $355M acquisition by E.l.f., where squalane is headed, and data from our raw material, SULA BUTTER UNREFINED. On our end, we’re heading into Q4 with high hopes for the beauty industry’s market share, especially as it relates to biotechnology and testing. We’re still monitoring where celebrity beauty is headed. Moreover, indie beauty has been heavily targeted by heartwrenching closures despite promising market share growth — and we’re determined to get to the bottom of it, for you all.

So without further ado, let’s get into it.

Cash Flow

We’re sure this news is no longer new to many, but it poses serious implications for the direction of the beauty industry, and its overlap with biotechnology. Amyris, the biotechnology company and beauty brand incubator, has filed for bankruptcy.

Briefly, Amyris is an R&D company that incubates beauty brands, develops cosmetic ingredients, and is known for developing a synthetic version of squalane (we’ll get into that later). They were founded in 2003 with funding by the Bill & Melinda Gates Foundation, and specifically set out to build what former CEO John Melo describes, “the industry’s first clean and sustainable brand incubator.” Some of Amyris’ well-known brands (three of the seven of the brands) are celebrity-founded - namely 4U by Tia (hair brand Tia Mowry), Rose Inc. (makeup brand by Rosie Huntington-Whiteley), JVN Hair (hair brand by Jonathan Van Ness) — inveitably, many of these brands are now up for sale. Amyris also birthed their most notable brand, Biossance, in 2016, which features Amyris’ popular squalane material.

Amyris has seen many foreshadowings of hardship through quite a hectic year, including the resignation of their longtime CEO John Melo, layoffs of 408 employees in June 2023, and selling their squalane material to ingredient manufacturer Givaudan beauty for $200 million cash in February 2023 (Business of Fashion). Since the debut of Amyris’ first celebrity brand in 2016, Amyris’ focus seems to have shifted from an ingredient-inspired biotechnology core, to a celebrity/brand incubation core, especially after the bustling success of squalane and Biossance. Many journalists have described this shift with keen criticism as an “‘accidental’ celebrity play”, and that “clearly the writing was on the wall”. Therefore, a pivotal question that has posed to the beauty industry over the past few years once again arises — how sustainable is celebrity in building a successful beauty business?

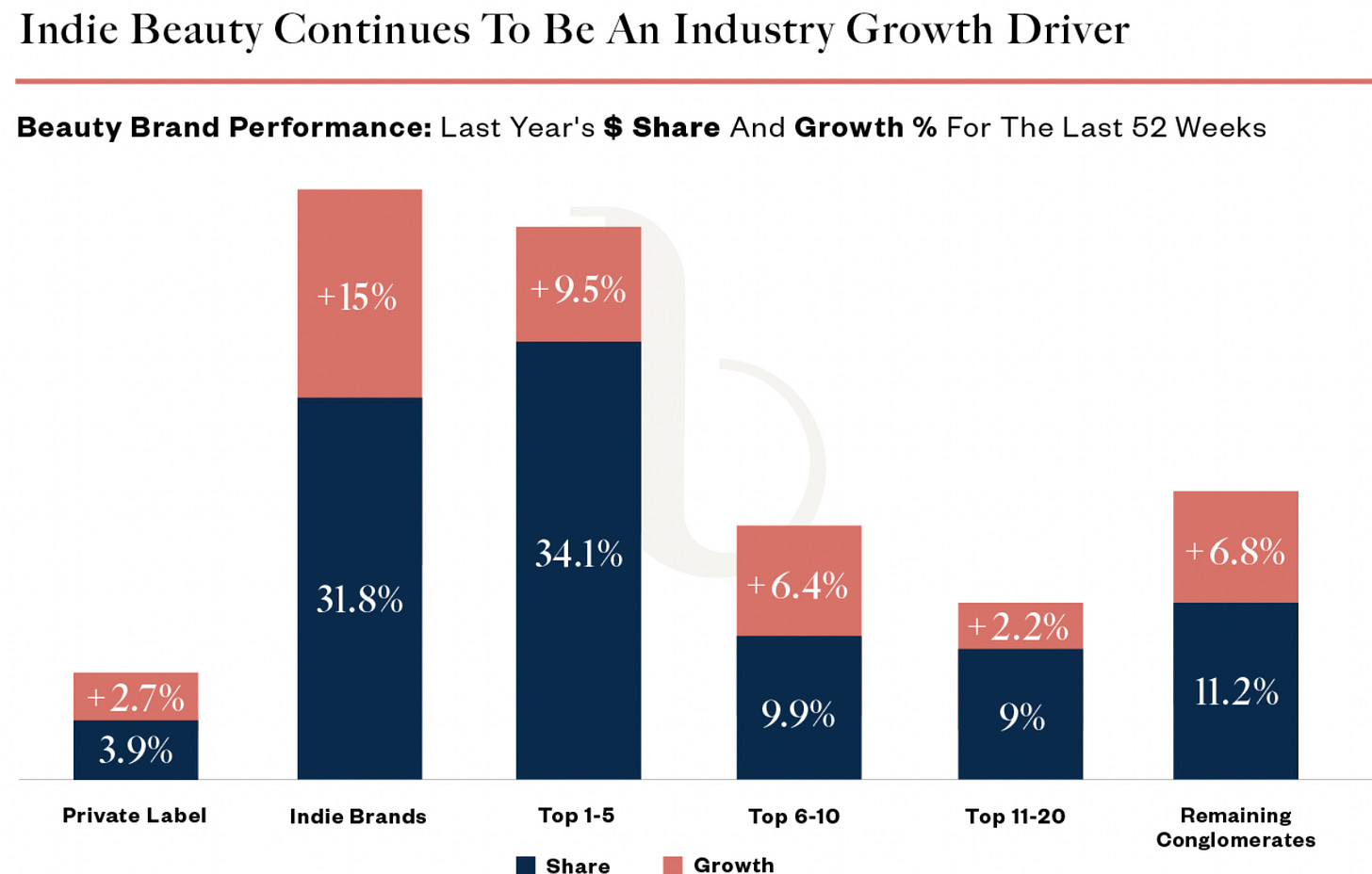

It’s clear that it’s been a difficult year of cash flow for the beauty industry. Closures and bankruptcies have riddled our timelines — including from beloved indie beauty businesses such as Curlbox, and Base Butter. The closure-bug seems to specifically target indie beauty, with several closures over the past months - more than we’ve witnessed in a long time. Despite this, indie beauty continues to secure steady market share in the industry, with the indie beauty landscape growing 15% in market share over the last year (image provided by Nielsen Q, published in Beauty Independent).

Not only do the numbers continue to provide a taste of hope, but so do testimonies such as Naturium’s recent acquisition by E.l.f. for $355 million. While Naturium, founded in 2019) already carried momentum from being led by long-term makeup artist and skincare influencer Susan Yara, the brand secured continued notoriety through a large volume of sales (projected to generate $90 million this year alone), credibility through leaning deeply into influencer marketing, and retail. However, with fragile supply chains, rising material costs, and ever growing exclusivity around retail, it’s becoming increasingly difficult to keep business afloat.

On our side at SULA LABS, we put in an immense effort to prepare beauty founders to spend smart, keep margins high, and COGs as low as possible without compromising quality. Therefore, we recommend the following:

Negotiate with your manufacturers at every step of the way — at the end of the day, they need your business. Cut costs where you can - purchase ingredients directly from reputable suppliers where you can in advance of production, cut down on secondary packaging, and stay in the loop as much as you can.

Make sure that your COGs make sense — we literally cannot emphasize this enough. If you want high-quality, newer actives, you’ll likely compromise on other pricey aspects of the product (i.e. primary and secondary packaging, shippers, and the array of ingredients that you desire). For example, a product with bakuchiol, glutathione, and THD ascorbate (aka “brightening” actives) in airless pump packaging will cost way more than a product with glutathione (singular, effective brightening active), and airless pump packaging (and would cost lower with non-airless packaging). Let’s also not forget how MOQs play into this.

Lower MOQ does not equal lower product cost — we cannot emphasize this enough as well. In fact, in most cases, it means the opposite. Not only do production volumes have MOQs, but so do individual ingredients, and packaging. For example, a production run on products can be 5000 MOQ, but your packaging is 10,000 MOQ. Beauty founders ask yourselves - how do you manage this? Moreover, if your production size is low, your ingredient costs do not lower with this.

We’ve been gauging whether a “unit costs” workshop or SULA LABS Report issue on making smart money decisions during product dev would be helpful. If there’s interest, we’ll make it work.

As skincare savvy consumers became introduced to the world of a moisturized and strong skin barrier (cc: “Glazed Donut” skincare), ingredients like squalane rose to popularity. Your skin naturally produces lipids and oils that help keep your skin elastic and plump. Squalene (with an E) is one of those lipids naturally produced from our sebaceous glands that helps our skin stay moisturized and youthful looking — but as we age, our skin produces less of it which is where topical skincare like moisturizers and oils come in. In many ways, adding squalane to a product provides a biomimetic advantage — our skin produces squalene, so it’s necessary to put it back onto our skin through our products, especially when monitoring aging behaviors. Biossance popularized Squalane (with an A) using Amyris’ raw material, to not only replenish that moisturization, and treat early signs of aging due to its antioxidant properties.

Briefly, the difference between the squalene (with an E) naturally found in our skin and the squalane (with an A) found in our skincare is the conversion process that makes it suitable for topical use. Squalene that’s naturally found in humans, animals, and plants is too unstable to be used in skincare, and can be converted to squalane — but this is typically sourced from sharks. Due to the animal extraction processed involved with synthesize squalane, successful efforts have been made to biosynthesize a synthetic squalane (with an A) to make it more shelf stable in skincare, and offer a plant-derived alternative sourced from olives. In 2008 Unilever and L’Oreal publicly agreed to stop the usage of shark-derived squalane in their moisturizers and lipsticks after it was announced the sharks that supplied the squalene were endangered.

As mentioned, Biossance is one the first brands to commercialize squalane as a hero ingredient since its founding in 2016. It heroes its efforts in using ethically sourced squalene from sugar cane with claims that it’s biosynthesize squalane is purer and more effective than shark derived squalene and the switch helps save more than 2 million sharks per year from poaching. Squalane also continues to be highly coveted among consumers looking for emollient properties - according to Spate data, “Squalane face moisturizer” averages 2.2K average monthly searches (+40.4% YoY) and “sunscreen + squalane” averages 1K averages searches (+50% YoY) with Biossance being the key driver of those searches across both categories. Squalane can also be found in high-performing products such as brands like Indie Lee, The Ordinary, and Youth to the People.

Squalane Facial Oil — Includes 100% olive-derived squalane - no other ingredients

Youth to the People

Adaptogen Deep Moisture Cream — features squalane as an emollient for moisturization efficacy

Superberry Hydrate and Glow Oil — features squalane as an emollient for moisturization efficacy

The Ordinary

Squalane Cleanser — an interesting, exciting application of squalane - utilizes squalane as a moisturizer to provide emolliency, slip, and hydration to the face while cleansing.

However, as demonstrated in tandem with Amyris, Spate SEO data for squalane shows that squalane is down -10.7% year by year in terms of searches from consumers. Now, we are curious to know from our readers:

Ingredient & Vendor Reports

Speaking of moisturization, this month, we are excited to debut testing results on our raw material, SULA BUTTER UNREFINED — an unrefined, triglyceride-rich shea butter sourced from a women-owned cooperative in Tamale, Ghana.

Below are some exciting testing results we’ve performed on immediate hydration in comparison to an unrefined shea butter. A bland moisturizer with 1% refined shea butter was formulated and tested against a bland moisturizer with 1% SULA BUTTER UNREFINED to determine immediate difference in hydration using a Moisturemeter SC. There was a 31.1% increased difference of hydration after 8 hours between the SULA BUTTER UNREFINED moisturizer versus the refined shea butter moisturizer.

We have been distributing the material for use in both SULA LABS developed products, and non-SL developed products. If you’re interested in utilizing a rich, hydrating shea butter material in your products that directly supports a women-owned cooperative in Tamale, Ghana, give us a shout at hello@sula-labs.com.

And that’s a wrap for this month! ☻ Like what you read? Email us with questions, comments, concerns, or category suggestions at hello@sula-labs.com. Thanks again to our friends at Spate for the continued SEO data!

Till next time,

The SULA LABS Team