Abstract

As the first quarter of the year is soon to end (trust us, we’re shocked too!), our team has internally seen a large volume of pending sunscreens about to launch, as well as a transition to sun-care and body-care related discourse. Of course, we’re adding to the conversation this month as we write on the difficulty of developing sunscreens, and why it’s so damn hard to do.

Other exciting things we’ve observed this month are this Journal of Drugs in Dermatology study on dermatologists and the role that TikTok education now plays for them, as well as a poll from Cosmetics and Toiletries that begs the question — do cosmetic marketing teams understand the limitations of science? The result is shown below.

Ultimately, in this issue of the SULA LABS Report, we break down data-driven product trends observed right now in the industry (caffeine is in right now), dive into the hot topic of the cost of sunscreen development, and end off with literature on raw materials we’ve spotted.

Now, let’s get into it.

Cash Flow

Is it just us, or is it getting hot in here?

The race to develop “the perfect sunscreen” is still long running, and many brands have become more vocal about the barriers faced in the generally unstandardized FDA testing processes for sunscreen efficacy and Sun Protection Factor (SPF), as well as the financial difficulties in developing a sunscreen. In Beauty Independent this month, KraveBeauty founder Liah Yoo gets candid in just how difficult it really is to develop an effective, sensorial sunscreen in the United States.

SPF is near and dear to our hearts here at SULA LABS, and we’re constantly engaging in market research on sunscreens to elucidate effective trends in the industry that tell a story on where we’re headed. Our star research associate Poornima Dorairaj identified a few market trends, such as the best-performing sun care brands in America (we see you, Black Girl Sunscreen!) as of now, validated by SEO data:

Additionally, as our founder AJ hypothesized in Beauty Independent last month, hybrid sunscreens have been identified by UL as a rising cost-effective alternative (from an R&D perspective) that also addresses white cast, following in the footsteps of beloved K-Beauty products. A few US brands have followed suit:

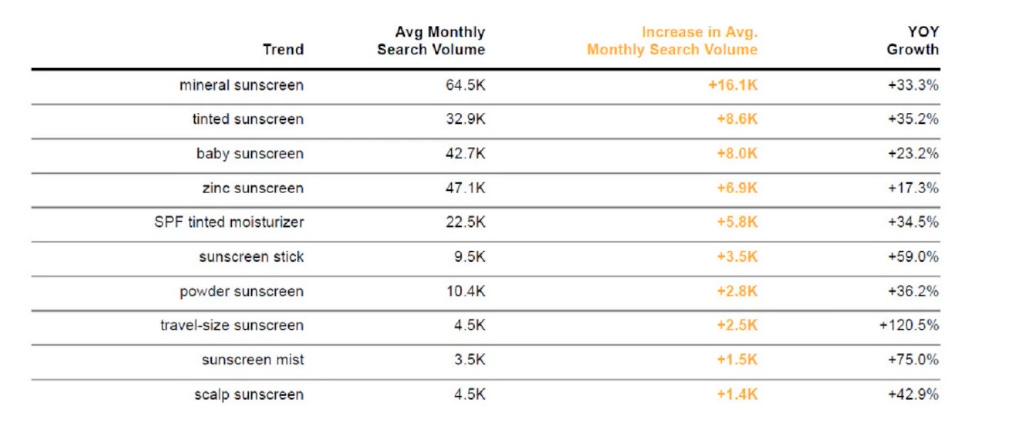

And as difficult is to just develop a functional sunscreen, consumer standards have skyrocketed to also have more functional utility (such as powder-based, scalp-friendly, and travel-size), as evidenced by SEO data provided by UL:

So what does this have to do with cash flow? As shown above, it costs tens of thousands of dollars and takes plenty of time to develop a sunscreen. In fact, our own internal checklist for sunscreen development is quite lengthy:

Which inherently provides a high barrier to entry for all brand founders, but especially Black and brown brand founders that not only historically receive less VC funding, but also typically cater to Black and brown consumers, which have the largest gap in the market for sunscreens that even attempt to address things such as white cast.

When brands come to us for sunscreen development, we always advise to realistically plan for on average $30,000 spent through the testing and registration process, which is very unrealistic for many brands. Getting a sunscreen formula right on the first round of testing is not always the case (even rare), resulting in retests to reach broad spectrum and SPF targets. So where do we go from here?

We believe that the first step to democratizing the sunscreen development process is the FDA approval of additional UV filters that are more consumer-forward (sensorially, and protective-wise), as a new UV filter has not been approved in decades. Secondly, while seemingly unrelated, a need for funding Black and brown founders is dire, as they are slightly more likely to engage in R&D with Black and brown end consumers in mind.

The sunscreen process is most definitely not easy (although, we’re here for you founders that are interested in it), and we most definitely hope to see some change soon. Thankfully, the FDA is in the midst of reviewing plans to issue a deferred rule-making process in order to allow further studied UV-attenuating ingredients to be used in products now. According to the FDA, “The deemed final order for sunscreens includes certain requirements about active ingredients from the 1999 final monograph regulation for OTC sunscreen products, which never took effect, and the labeling and effectiveness requirements from a final 2011 labeling and effectiveness testing rule.”

So let’s keep our fingers crossed.

Product Radar

First, baggage claim: According to Market Research Reports, under eye creams employing historical anti-aging technologies, rather than the traditional hydrating eye cream, have been emerging over the past few months, indicating a region-specific skincare trend (rather than global facial skincare). We’ve seen this over the past month with new launches, such as:

Youth to the People PEPTIDES + C ENERGY EYE CONCENTRATE ($48)

The technology: Contains peptides (palmitoyl tripeptide-7, dipeptide-2, palmitoyl tripeptide-1), Vitamin C, and caffeine, which is a historically popular topical undereye treatment to “awaken” the area.

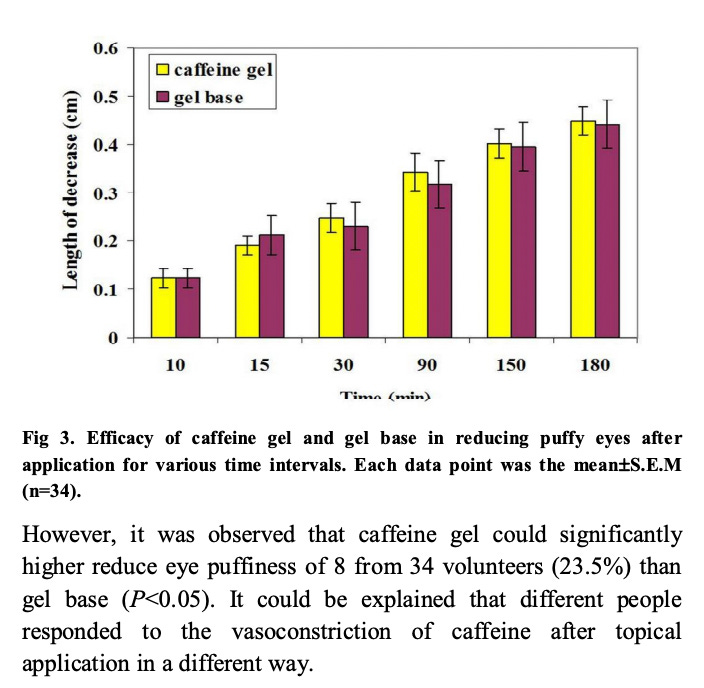

The science: While peptides have historically demonstrated efficacy in plumping fine lines and wrinkles, caffeine alone as an effective undereye dark circle decreaser and depuffer is still largely being studied. For example, a 2010 study in the Journal of Applied Pharmaceutical Sciences evaluated a 3% caffeine gel’s ability to reduce puffiness under the eyes (versus a control, which was a gel with no caffeine). The results display efficacy from 8 out of 34 volunteers:

Ilia Bright Start Retinol Alternative Eye Cream ($46)

The technology: Uses a peptide (Acetyl Hexapeptide-8), and caffeine, and claims to “deliver the benefits of retinol without the drawbacks”.

The science: A clinical study for this product was performed:

The results demonstrate that 25/30 subjects observed any noticeable change in appearance of fine lines and wrinkles, smoothness, and brightness after 6 weeks, however the most immediate result observed was moisturization (observed after application). Additional things to consider in the results are:

How often the subjects applied the eye cream (likely daily).

The results mention that the hydration of skin and reduction of dark circles was evaluated through a separate instrumental study, yet the exact extent of hydration and reduction of dark circles is not mentioned.

The age range of subjects was 39-65, indicating a target audience for this product.

Next, stick it to them: This month, Business Insider identified multi-balm sticks as the next big thing for on the go, skinimalist, skincare. From a formulation perspective, these are also cheaper to formulate and produce, especially when anhydrous (meaning, no water added). Many launches lately of this concept have been seen ranging from moisturizers to sunscreens to even masks, such as:

WYOS The Big Reveal Purifying Face Mask Stick ($24)

Features: Kaolin, Vitamin C (Sodium Ascorbyl Phosphate), Caffeine

Coola Refreshing Water Stick SPF 50 ($30)

Features: Plant stem cells, niacinamide, and hot-topic UV booster butyloctyl salicylate, which functions similarly to “chemical” UV filter ethylhexyl salicylate

And lastly, more skin tech has emerged more over the past few months (likely in the wake of the pandemic), as an at-home alternative to esthetic treatments. Some on our radar are:

CurrentBody Skin LED Eye Perfector ($249)

Anti-aging LED light therapy treatment to improve fine lines and eye wrinkles. 4 clinically proven LED wavelengths target areas of concern such as elasticity, dark circles, and eye bags.

Pain-free, hands-free simplicity 3-minute treatments to create younger looking eyes.

Odacite Cyro-Tech Facial Tool ($75)

Instantly refresh and rejuvenate your glow with the power of cryotherapy - AKA cold therapy - no freezer necessary. Powered by Terahertz, this multi-purpose facial tool instantly revitalizes depuffs, soothes, and firms the appearance of the skin.

Best for puffiness, inflamed acne/breakouts, dull/tired skin, facial tension, sagging skin, and signs of aging.

Ingredient Report

Crodasone Cystine — the “snap-back” hair ingredient

Supplier: Croda Inc.

INCI: Cystine Bis-PG-Propyl Silanetriol

Summary: This hair active employs a heat-activated protein (made of amino acids) that plays a key role in the structure of hair. As this material bonds into the hair, it improves mechanical properties of the hair, and the curl retention after perming.

Benefits: Prevents cuticle damage from brushing hair, enhances the glossy appearance of hair

Efficacy Studies:

Methods: The investigators simulated damaged hair from repeated combing and brushing of it (50 cycles, 100 cycles, and 200 cycles), then treated the damaged hair with 3% Crodasone Cystine to see the results.

The results: