A Behind the Scenes Look at Tariffs in Cosmetics: Real-time Examples + Statements from Suppliers (Special Issue)

Authors: AJ Addae

Abstract - A letter from the founder, AJ Addae

In October 2023, we published an issue of the SULA LABS Report called The Cost of Making Skincare, which remains our most viewed issue, to this day. We covered what goes into the unit costs - and therefore retail price - of skincare products from a formulation and manufacturing perspective. Today, in light of the recent announcement of added tariffs on imports into the United States, we’re revisiting the iconic cost pyramid we illustrated, with a special focus on the bottom two pillars - the cost of goods.

In this special issue, we’re reporting a behind-the-scenes look at how cosmetic suppliers are currently responding to the ongoing tariffs, with their statements, cost break downs, and real life examples. We also invited our friend and colleague Paul Ginzburg, founder of cosmetic formula costing tool Sleek Flow Labs to help crunch the numbers behind how tariffs are impacting the beauty industry and rising costs.

Lastly, we’re thrilled to announce continuation of our R&D Refresh Sessions, designed to give you the fast-track support you need to get unstuck and move beauty brands of all sizes forward. Honestly, we were offering these for just April due to an influx of inquiries, but they have been a hit and incredibly helpful for beauty brands — so we’re continuing these along with our 15% discount for SULA LABS Report subscribers, and a 10% discount for the month of May for any non-paid subscribers who have focused questions about cost savings.

Now, let’s dive in.

Ingredient and Packaging Pricing Pressures Amid Tariff Changes

In April 2025, the U.S. government announced new tariffs that are already reshaping pricing structures across the beauty supply chain. While much of the conversation has centered around finished goods manufacturers, tariffs are having an immediate and direct impact on ingredient and packaging suppliers as well. Here at SULA LABS, we’ve had our ear to the ground on this conversation for a while now. While we’ve seen a lot of questions from the beauty community on how tariffs are impacting the beauty industry, we’ve seen very little real-life examples. So this month, we’re dabbling in a little bit of investigative journalism to bring these answers to you.

In efforts to help demystify the lack of clarity around tariffs in cosmetics, we’ve collected statements from ingredient suppliers who have addressed the tariffs’ impact on pricing, and interviewed our friend Paul Ginzburg, founder of next-generation costing tool Sleek Flow Labs and former Good Face Project employee, to help brands understand exactly what is happening behind the scenes and what to expect in the months ahead.

Here’s how ingredient suppliers are responding:

RAHN USA, a leading supplier of cosmetic ingredients, issued a letter to customers in mid-April emphasizing the inevitability of cost increases in a recent letter to customers, confirming a 10% increase on affected products, and noting that their cosmetics portfolio does not include materials sourced from China.

Lipoid, Inc., an ingredients supplier based in New Jersey, issued a letter to its customers on April 10 noting that while the situation “remains fluid”, a few cost adjustments will be implemented:

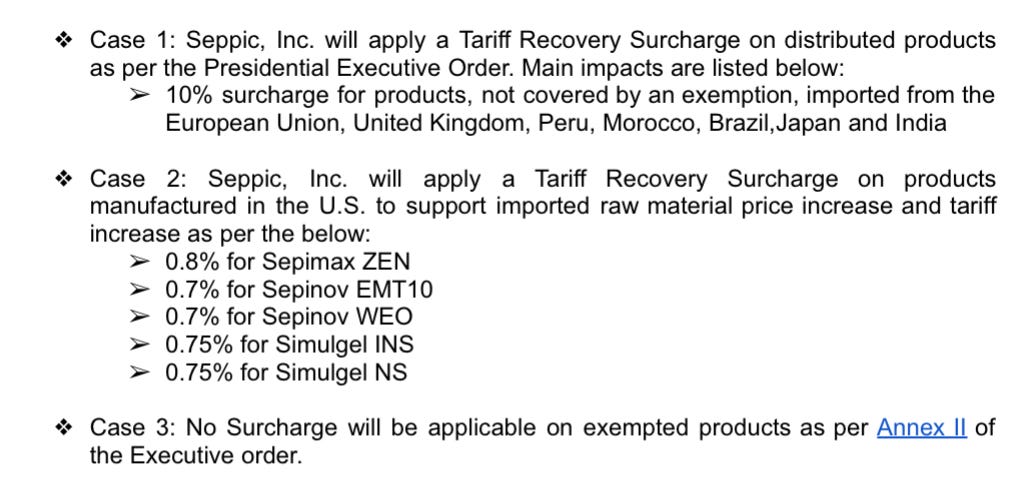

Seppic, an ingredient supplier that we source from extensively here at SULA LABS, issued the following response to its customers announcing a Tariff Recovery Surcharge on its imports starting on Monday April 21st, 2025:

Below is an ingredient quote we recently received from an ingredient supplier, at purchase quantities of 5kg, 10kg, and 25kg, with a newly added tariff charge in addition to each order quantity. The column “Unit Price” shows how the implemented tariffs scale with the price breaks depicted (tariff cost at 5kg, versus 10kg, versus 25kg).

As you can see, there is a clear attempt for tariff costs to remain proportional across ingredient purchase quantities. We imagine that ingredient suppliers and contract manufacturers are feeling the source of the squeeze, as suppliers are less likely to go down on margins of their ingredients, and CMs are less likely to compromise on the margins of their purchase orders. This leaves brands and customers in a tricky place.

Cosmetic Pricing Expert Paul Ginzburg on How Tariffs are Hitting the Beauty Supply Chain

Our friend Paul Ginzburg over at Sleek Flow Labs weighs in to help digest how the tariff situation is likely to unfold across the industry. You might recognize Paul previously from cosmetic formulation software Good Face Project, a long time partner of SULA LABS.

On the immediate impact to brands and what they should expect to see:

"Beauty brands already realize that tariffs will impact them and may be trying to determine how big the impact will be.

When sourcing the finished product from an OUS manufacturer, they can expect a 10% increase from most countries, significantly more if coming from China. Sourcing from a domestic manufacturer using OUS ingredients could result in even higher increases.

It's not as cut and dry on the tariff transparency once it hits the contract manufacturers, and often the added cost can amplify. It’s not malicious, believe me I’ve seen amazing examples of contract manufacturers advocating for their brands, it’s that they typically operate with systems that are not built to isolate tariff costs.

A simple 10% ingredient tariff can turn into a 14% increase to the brand’s finished product cost. Brands should be aware they likely won't see a separate line item for tariffs [from manufacturers], and that it is rarely just a pass-through cost."

On who ultimately bears the cost:

“The tariff burden will ultimately touch every level of the supply chain, but not in a perfectly linear way.

Ingredient suppliers are generally doing a good job of being transparent, breaking out tariffs as separate costs rather than quietly folding them into higher ingredient prices. But contract manufacturers often don’t carve it out separately. Their margin is typically applied to the entire cost of goods, tariffs included.

Brands are then forced to make a decision:

Pass the increase directly onto customers

Raise prices even higher to preserve their margin

Or absorb the margin loss themselves to maintain customer loyalty

On supplier behavior so far:

“From what I’ve seen ingredient distributors are trying their best to be transparent, often line-item-ing the tariff separately and simply passing through the added cost without adding new markups. Most ingredient suppliers will likely follow suit because A) it surely seems like the right thing to do and B) competition is high, and precedent has been set.

Because manufacturers’ costing tools aren’t easily adapted to show tariffs as standalone line items, brands often lose some of the transparency and it gets diluted once more when brands make their final decision on consumer pricing.

One of the biggest challenges ingredient distributors are facing right now is timing. Some products were already in transit when the new tariffs took effect and should not be subject to them, while future orders will be. But tariff rates are changing rapidly.

I recently came across a scenario where a contract manufacturer advocated for their brand by pushing back against an ingredient supplier who had prematurely applied blanket price increases to orders that should have been exempt from the new tariffs.”

On how Sleek Flow Labs is addressing the issue:

“Tariffs are just the latest curveball adding complexity to formula costing — but they’re far from the only one.

We set out to build the world’s best formula costing platform, designed to handle price breaks, pack sizes, excess materials, and now, tariffs too. Contract manufacturers can easily plug in tariff costs on the fly, keeping quoting fast, smooth, and stress-free. Quotes are turned around in minutes, and vendor pricing communication is simpler than ever."

As for the SULA LABS team, when we formulate a product, we’ve made it a practice to quote out each formula’s unit cost, for years, and we plan to add implied tariff costs into formula costing. Internally, we’ll continue monitoring tariff-driven changes in our own quoting and formulation workflows, and we recommend brands begin asking their vendors for itemized material quotes that include any tariff-related increases.

The R&D Reset Sessions + Discounts Just for You

Speaking of expert product development, last month we launched our R&D Reset Sessions, a dedicated, no-BS, 1:1 session where we help diagnose and solve the toughest of product development problems. We believe that sometimes you don’t need a full R&D contract - you just need to sit down with a product developer who actually knows their stuff and get the right guidance, fast.

Not only were these a hit for April, but we found that the topic of cost-saving and navigating tariffs was highly embedded into our April sessions. That’s why we’re thrilled to announce that we’ll be continuing R&D Reset Consulting Sessions for $250/hr, with a 15% discount for paid SULA LABS Report Subscribers, and a 10% discount for non-paid subscribers (for the month of May only) who have questions regarding all things money — tariffs, cost savings, and saving cash during like product development, or designing claims studies that give you effective claims, and a bang for your buck.

What We Also Cover:

Claims & Consumer Studies – You want to say “clinically proven” or “reduces dark spots in 4 weeks,” but what testing do you actually need to back that up? Or, need a research team to help write up a claims-backed brief? We’ll help you figure out the best path for airtight claims.

Compliance & Testing – What’s stopping your brand’s next launch from landing in certain retailers? We can assess a product’s testing compliance, ingredient restrictions, and global regulatory requirements so you don’t hit roadblocks later.

Formula Optimization & Product Briefs – Already have a formula but need a convincing brief to send to stakeholders or retailers? We’ll create one backed by scientific precision to make sure your product positioning is clear and compelling.

Tech Transfer & Manufacturing Logistics – Perhaps you’re a founder that’s been making your product in small batches, but now it’s time to scale. Do you know your product’s unit costs? Did you do your compliance testing? We’ll walk you through what needs to change to make sure your first large-scale production run is successful.

Long-Term Product Strategy – What should your next products be? How do you create a signature ingredient complex that makes your brand stand out? What’s the right testing strategy for retail expansion? We’ll help you map it all out.

Before your session, fill out this diagnosis form, which takes just a couple of minutes to fill out and ensures we don’t waste a second of your session. Think of it as your way of making sure you leave with real, actionable solutions—not just more questions.

Till next time,

AJ Addae + SULA LABS